Swissquote is one of the most famous Swiss brokers, and many investors are using it. It has a lot of features that make it attractive to people who want to invest in the stock market. Is Swissquote a good broker? Let’s follow the following article of Top 10Forexglobal!

Swissquote broker overview

The Swissquote broker is part of the Swissquote Group Holding SA company. It is a Swiss banking group operating in many countries. The Swissquote broker was founded in 1996, making it a very well-established company.

Swissquote has a banking license and is listed on the stock market. This listing makes Swissquote very transparent since they must reveal detailed financial reports.

At the time of this writing, Swissquote has more than 400’000 users. It offers access to stocks, bonds, funds, Contracts For Difference (CFDs), and more. They have access to 60 stock exchanges over the world. If you are a simple passive investor like me, they have much more features than you would ever need.

They also offer some services outside of the stock market, like cryptocurrencies. But I do not cover this part in this review. Instead, I want to focus on their trading features. They have separated the two features on their tools too.

Swissquote Account Types

Swissquote has four different account types:

- Trading. This account is the one that interests us for this review since it offers access to trading in the stock market.

- Forex. An account for foreign exchange traders.

- Robo-Advisory. You can also use Swissquote as a Robo-Advisor.

- Crypto-Assets. A special account where you can trade many cryptocurrencies.

Swissquote Fees

In the long term, you need to reduce your fees. Investing fees are extremely important. Therefore, we must look at the fees of the Trading account at Swissquote.

You will pay 0.025% in custody fees for the account. This fee is charged each quarter, with a minimum fee of 15 CHF. Fortunately, there is a maximum of 50 CHF per quarter. So, the maximum fee you will pay is 200 CHF per year.

As far as Swiss brokers go, this is a reasonable fee. But this is still not negligible. This custody fee is the only fee you will pay outside of trading fees. They have no extra account management fees or inactivity fees.

Let’s start with Exchange Traded Funds (ETFs) since they are the best instrument for passive investors in Switzerland. With most brokers, ETFs have the same trading fees as stocks since they are traded similarly.

However, with Swissquote, there is a small difference. For some ETFs, called ETF Leaders, you will pay a flat fee of 9 CHF per trade on the Swiss Stock Exchange. If the ETF is listed in USD, you will pay 9 USD (and the same logic for GBP and EUR).

In the ETF leaders, you find many good ETFs by Vanguard, iShares, UBS, etc. So, as long as you buy your ETF on the Swiss Stock Exchange, you should be okay with the flat fee. For ETFs on other stock exchanges, the fees will be the same as for stocks.

Then, you pay a fee for each stock exchange based on the transaction value. The fees are the same for buy and sell operations. For instance, here are the fees for the Swiss Stock Exchange (SWX):

- 0 – 500: 9 CHF

- 500.01 – 2000: 20 CHF

- 2000.01 – 10’000: 30 CHF

- 10’000.01 – 15’000: 55 CHF

- 15’000.01 – 25’000: 80 CHF

- 25’000.01 – 50’000: 135 CHF

- From 50’000.01: 190 CHF

And here are the fees for American stock exchanges (NYSE or Nasdaq):

- 0 – 500: 9 USD

- 500.01 – 2000: 25 USD

- 2000.01 – 10’000: 30 USD

- 10’000.01 – 15’000: 55 USD

- 15’000.01 – 25’000: 80 USD

- 25’000.01 – 50’000: 135 USD

- From 50’000.01: 190 USD

These fees are not cheap, especially for small transactions. For instance, if you buy 1000 CHF of shares, you will pay a 2% fee! 2% is a huge fee, and you must be careful about it. But if you buy for 10’000 CHF, you will pay 0.3% in fees. 0.3%is still a considerable fee, but it is acceptable.

And when we compare Swissquote with other Swiss brokers, these fees are on the low side.

We also have to consider the currency conversion fee. At Swissquote, you will pay 0.95% of the exchange value if you convert CHF to another common currency like EUR and USD. The fees may change if you use other, more exotic currencies.

Once again, this is a significant fee. You need to be careful about this fee. You pay this fee every time you buy or sell an ETF in EUR or USD. Over time, this can quickly accumulate to be a significant amount of money lost to fees.

Finally, the last fee we will look at is the Swiss Stamp Tax Duty fee. Since Swissquote is a Swiss broker, you will have to pay this fee for each stock market operation. This fee is 0.075% for Swiss shares and 0.15% for foreign shares. This fee is the same for each Swiss broker.

Overall, Swissquote is not cheap. Several of its fees are relatively high, mainly currency exchange and trading fees for small transactions. However, compared with other Swiss brokers, these fees are affordable. Indeed, Most Swiss brokers are even more expensive than Swissquote.

In fact, for transactions on the Swiss Stock exchange, Swissquote is among the cheapest Swiss brokers. The only place where it does not shine is for foreign currency exchange.

Opening an account at Swissquote

Opening an account at Swissquote can be done entirely online. But you may have to wait until you get someone on call for the video identification, which can take a while (more than 10 minutes) depending on when you call.

Other than that, the account opening process is very straightforward. You will have to give your personal information and answer questions about your financial knowledge.

There is no minimum for opening an account. So, you can start trading with very little money. It is good, but be careful about the 60 CHF per year minimum custody fee. If you invest with very little money, this could be expensive.

Trading with Swissquote

Swissquote offers several options to trade stocks:

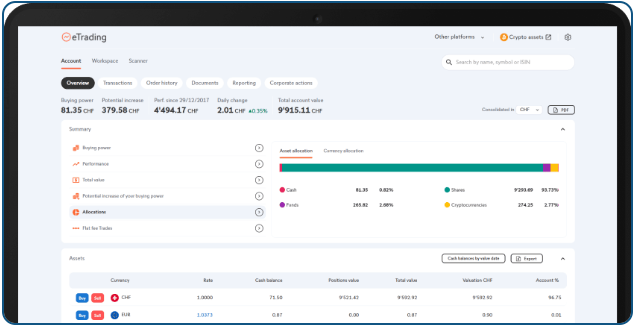

- The web interface can be directly used and has all the necessary functions.

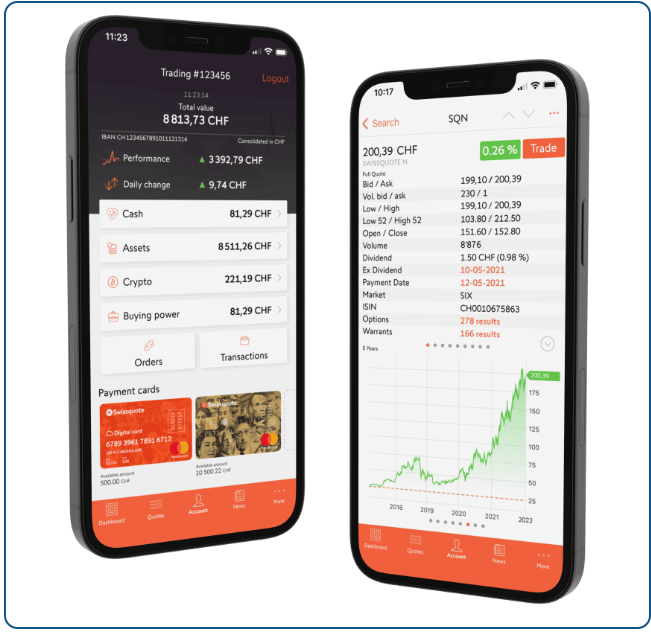

- A mobile application on iOS and Android.

- A desktop application primarily aimed at Forex trading.

Overall, there are enough options for everybody. The web interface should work for most people. And many people will also appreciate the mobile applications that let you do everything you need to do.

The only downside is that the web interface is a little complicated to use because of all the features that are crammed together. But once you find the features you need, you should be fine to use them. If you want to invest passively, you will only need a small fraction of the features available.

Is Swissquote safe?

If you invest a significant amount of money with a broker, you must ensure it is safe.

Swissquote is regulated in Switzerland by FINMA. Its other entities are also regulated in other countries.

Swissquote being well-established since 1996 and turning a profit for several years in a row, its risks of going bankrupt are slim. But it is still important to know what would happen if your broker bankrupts.

Since Swissquote has a banking license, your cash will be protected by Esisuisse for up to 100’000 CHF. Your securities should be fully guaranteed since they are supposed to be held in the custodian bank account in your name. It is a good level of protection.

As for technical security, you can opt for a second-factor authentication (2FA) for your account. I strongly recommend everybody to do that to improve the security of their account. I have not heard of any security issues within Swissquote; a good sign.

So, overall, investing with Swissquote is safe. As for investing in general, keep in mind that investing involves risks of loss regardless of the platform.

The advantages of Swissquote:

- Cheap compared to other Swiss brokers

- Relatively fast account opening

- A very vast range of investments

- Long experience

- Well-established company

- Good security

- Easy to use

Swissquote Cons

- Expensive currency exchange fees

- Expensive when compared to foreign brokers

- Video identification can take a while to complete