What is LiteFinance?

LiteFinance hay LiteForex is a broker operating since 2008 that provides both Social trading and ECN trading environments through a popular, industry-recognized technology based on MT4 and MT5 platforms.

This technology currently is the leading solution that provides extremely fast execution speeds and the most favorable quotes with spreads from 0.0 pips allowing you to benefit from it.

LiteFinance established global expansion through its offices in Cyprus and an international one based in the Marshall Islands.

Even though being a regulated broker, earlier LiteFinance had some complaints and issues with the traders that claimed non-transparent conditions LiteFinance provides which is why there were some concerns about LiteForex’s trustworthiness.

Yet, now we see that broker clears its record as more brokers signing for its service also regulatory overseeing from the European CySEC and ESMA regulations giving extra layers of protection, yet we recommend to do your research on LiteFinance Review as well and see whether it is a suitable broker for your need.

LiteFinance Pros and Cons

LiteFinance has a Long history of operation, good trading technology, and an ECN environment with Low Deposit requirements and Social Trading. Spreads are tight and good for Forex.

For the negative points, spreads are High for Stocks trading, International trading is done through an offshore entity in the Marshall Islands and there are Negative experiences from some traders.

| Headquarters | Cyprus |

| Regulation | CySEC, MIBS |

| Platforms | MT4, MT5 |

| Instruments | Forex, Metals, Oil, and Global Stock Indices |

| EUR/USD Spread | 2.2 pips |

| Demo Account | Available |

| Minimum deposit | $50 |

| Base currencies | USD, EUR, GBP, PLN |

| Education | Trading tools and Analysis |

| Customer Support | 24/5 |

Is LiteFinance safe or a scam?

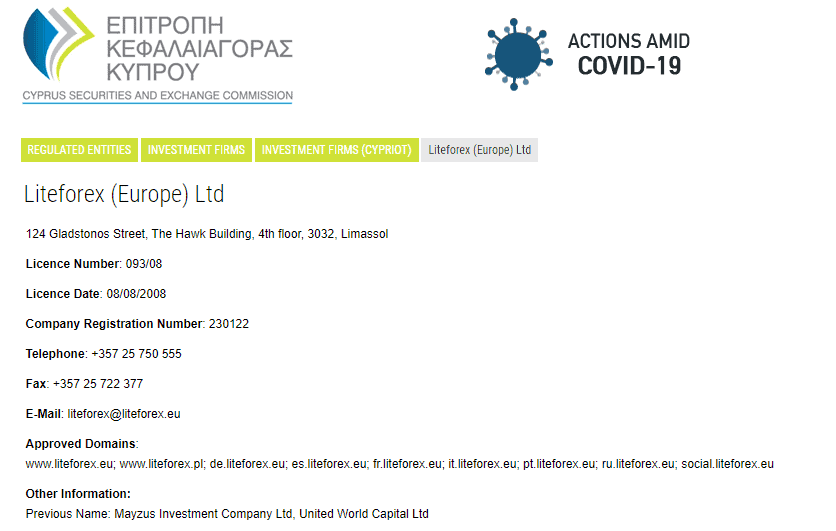

No, LiteFinance is not a scam, one of the entities is based in Cyprus while also regulated and set according to CySEC regulatory obligations and compliant with MiFID European directive. However, International accounts are under the Marshall Islands entity.

How are you protected on LiteFinance?

Obviously, the regulatory status is the most important measure you should always check, as in simple words it means a client is treated fairly according to the international laws and requirements while authorities stand behind traders and protect claims or concerns towards the operation.

Therefore, trading with LiteFinance Cyprus entity you can refer to CySEC in case of any violence, while the regulator himself constantly checks on the operation and environment the broker provides. Also, traders’ funds are segregated from the company funds, and the application of the standard covers investment protection.

However, different authorities apply adjusted regulation according to their legislation and particular laws, and as a result, may diverge from the entity or regulator.

Likewise, LiteFinance international is based in the offshore Marshall Islands which is a rather non-regulated entity, since its requirements are quite low and do not give sharp protection to clients. So always make sure to learn better under which entity you trade and what protection conditions apply to you, but it would be better to open an account under European ESMA regulations.

Leverage

Being a European broker, LiteFinance is also compliant with ESMA standards of lowered leverage while international traders actually still offered a quite high leverage level up to 1:500 on Forex instruments.

- International clients allowed maximum leverage 1:500

- European traders can use a maximum of 1:30

So before you sign in make sure you verify conditions and understand how trading works, as leverage is a tool of two sides that may maximize your gains and losses likewise. Besides, always make sure to learn how to use it and what the smartest way for a particular instrument is.

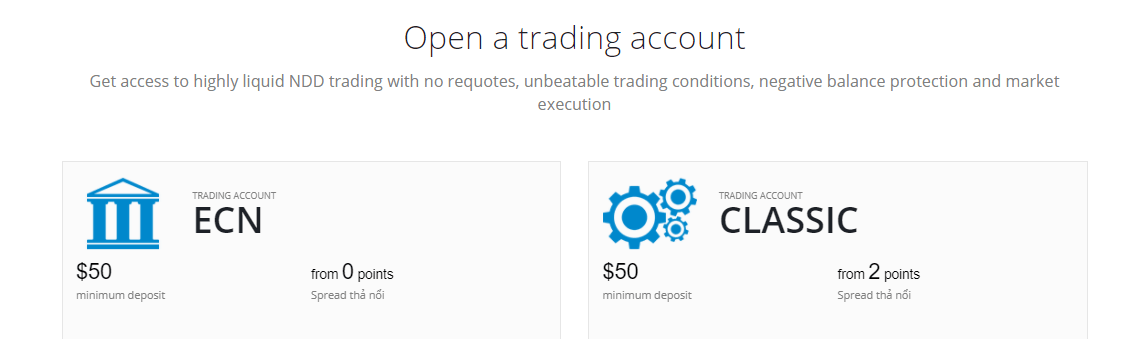

Account types

LiteFinance offers two account types with STP and ECN execution models accordingly with Standard Account where all costs built into a spread and an ECN account with raw spread and commission charge as a trading cost.

How to open your account

The account opening process is digital and easy to follow where you will be guided by the steps. Also be sure it is normal to upload your ID and residence registration, which happened during the stage of your identity verification necessary due to regulations.

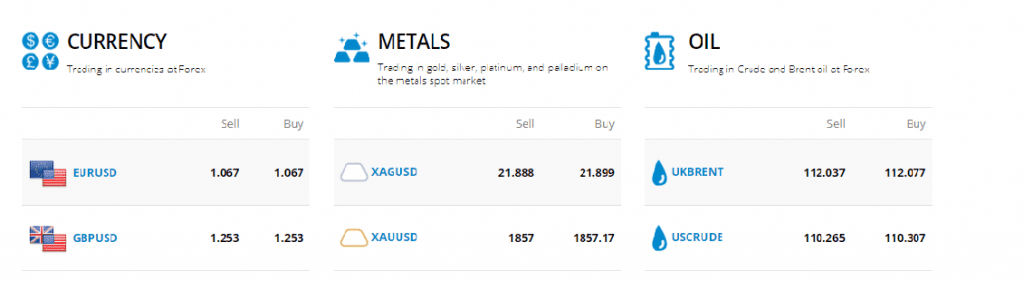

Trading Instruments

There is a range of products that you can choose from including popular Forex, Metals, Oil, and Global Stock Indices traded like CFDs.

Fees

Depending on the LiteFinance account type you select you will get specified fee conditions either based on spread only starting at 2 points or pay off commission per lot and get interbank spread from 0 pip. See the fee table below for additional fees.

Spreads

If you select Standard account you will find a floating spread averaging 2.2 for EUR USD pair and the ECN account proposes only 0.1 for the same pair plus 10$ commission.

Even though, the standard account spread might be slightly high compared to other industry proposals yet always be sure to see all the trading offerings so even a relatively high spread might be still a good deal.

Rollover

In addition, always consider rollover or swap rate as a trading cost, since the broker charges a small fee for the position being held longer than a day and is defined by the instrument.

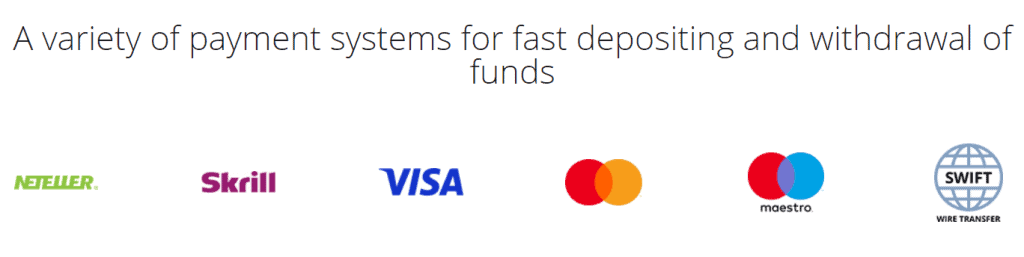

Deposit and Withdrawal Methods

There are a vast of payment methods that allow you to proceed with account funding, while some of them include fees and others are free of charge. Also, money transfers to or from the account depending on your residency and its applicable policies, in addition to entity rules of LiteFinance that apply.

Deposit Options

You may choose between the most common methods or options available in your region or also may consult customer support for advice.

- Bank wire transfer,

- E-wallets including Neteller and Skrill

- Credit Cards or Debit cards

As for the fund transferring fees, LiteFinance does not charge transfer fees for deposits yet various jurisdictions and payment providers may add on some fees, so be sure to verify this info as well.

Minimum deposit

The LiteFinance Standard account minimum is 50$ at the start, and the ECN account set is also 100$ and it is a great opportunity since the requirement is quite low. Yet, be sure to verify conditions and margin requirements for the instrument you wish to trade, also better check all the margins via Demo account at first before you sign in.

Withdrawal

The withdrawal fees are ranged also from one option to another, while some LiteFinance withdrawal options add no fees and others will add on a small mark up, see table below.

Trading Platforms

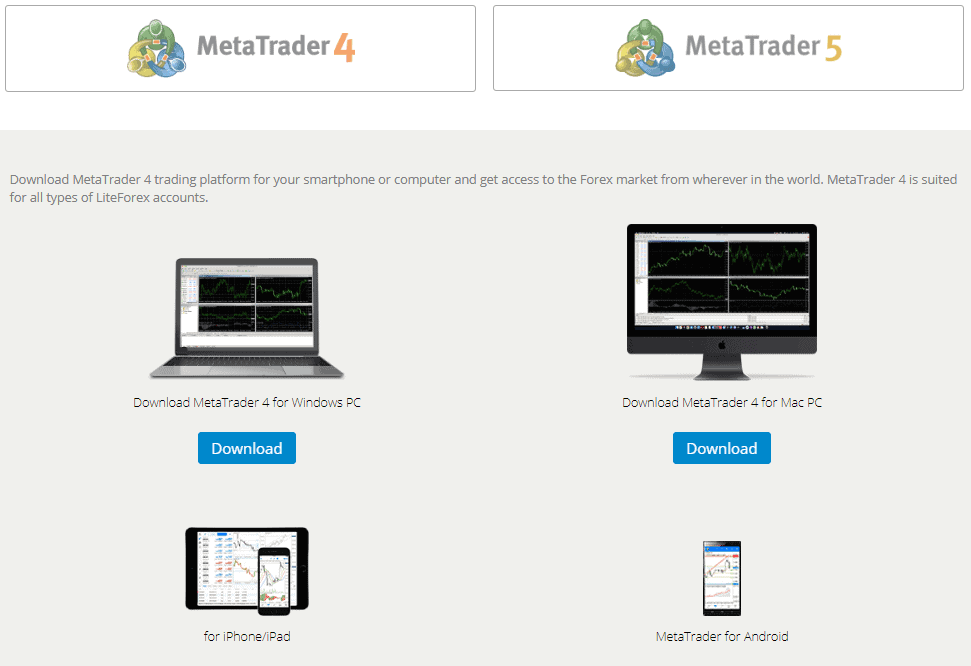

The choice of trading platforms between MT4 and MT5 is not a surprise as being an industry popular and recognized technology it is indeed one of the best choices for a various size or strategy traders.

| Pros | Cons |

|---|---|

| Mainstay on MT4 and MT5 platforms | No proprietary platform |

| Customer friendly design | |

| The Comprehensive range of tools | |

| Automated trading capabilities and Social Trading | |

| Clear look and fee report |

Web Trading Platform

Both MT4 and its newer version MT5 platforms do not require a big introduction, as platforms are known and popular and also available in various versions including Web Trading which requires no installation and is easily accessible.

Desktop Platform

Yet, for comprehensive analysis and day trading, you would prefer a desktop platform, where LiteFinance MT suits any device either PC or MAC.

Furthermore, the platforms are enhanced with automated trading and social trading capabilities with no restrictions on strategies, also additional complex order types.

Another point to admit is the great analysis tools that the platforms are enhanced with, which include algorithmic rules, indicators, Autochartist, and social trading functions also with Analytical materials from Claws&Horns.

Mobile Trading Platform

Mobile trading platforms for both iOS and Android with alerts, push notifications and full control over your trading account are also included in the package.

Customer Support

Another good point in its proposal is customer support available through various methods including Online Live Chat, Phone, emails, etc.

In addition, there are established centers in various regions, so Europe and international are covered, however, customer service is available on working days only 24/5.

Education

In fact, those who have information obtain advance among the others while trading, hence learning is an endless task, and the good news is that FP Markets supports personal strives and provides learning materials, analysis, and guides. This is done through FP Markets Trading Series presenting three sections that help to become a better trader that diverse to a different levels of traders.

Also, FP Markets provides great research tools with comprehensive analysis suitable for beginning traders and also supports everyday trading, while features including market outlooks, news feeds, trading ideas, and many more.

Conclusion

Overall, LiteFinance has a quite long history of operation and balanced trading conditions suitable for various trading styles, account sizes, and levels of experience. We should admit good analysis tools and technology solutions LiteFinance provides, also costs are rather good compared to other industry competitors.

Even though, there were numerous claims and complaints from the global traders presenting an impressive collection of issues that were faced during the trading experience they had. Of course, some of them might not be as they seem, we would anyway recommend trading with the Cyprus entity that gives an extra layer of protection, and of course, make your own research and LiteFinance Review before you sign in.